【PPV】 Financial Audit Onlyfans 2026 Archive Videos & Photos Fast Access

Looking for the latest financial audit onlyfans content repository released in January 2026. Our platform provides a massive collection of high-definition videos, private photos, and unreleased files. For your convenience, we provide direct download links with no subscription fees. Watch financial audit onlyfans in stunning 4K clarity. Our latest January folder contains exclusive PPV videos, behind-the-scenes photos, and rare digital files. Don't miss out on the latest financial audit onlyfans video uploads. Access the full folder today to save the files to your device.

A call to professionalism and preparedness an irs audit, particularly without receipts, is a significant event in any creator's financial journey When you need expert financial management for onlyfans income and taxes With taxfluence's professional guidance, onlyfans creators can turn this challenge into an opportunity for demonstrating their commitment to compliance and fiscal responsibility.

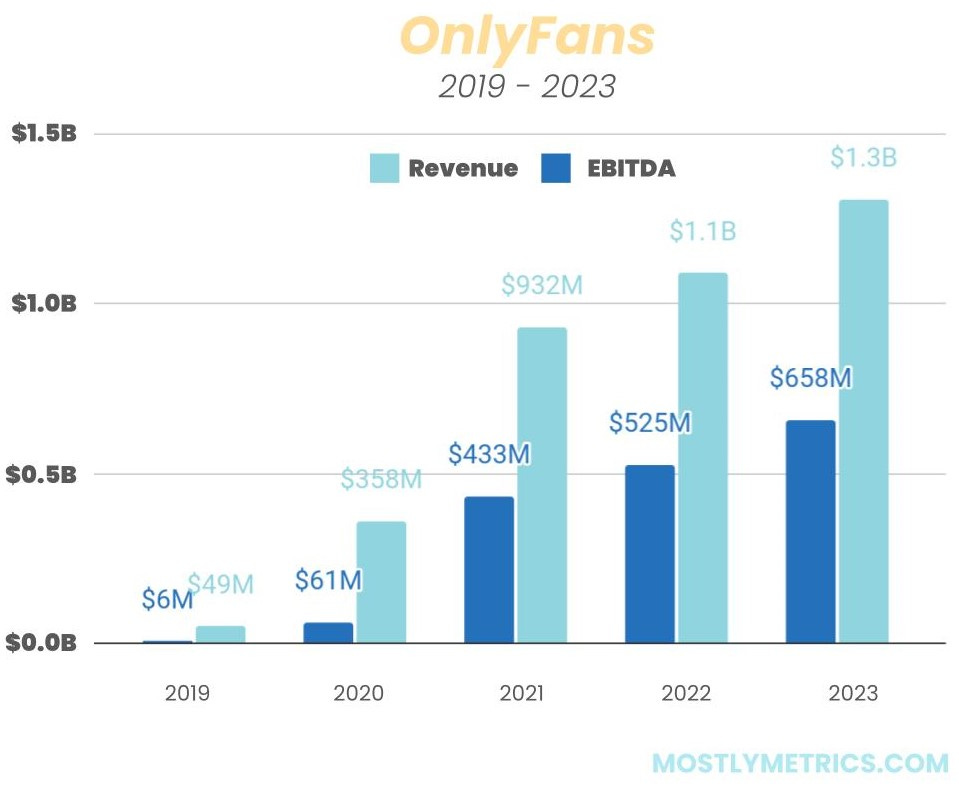

OnlyFans Financials Revealed - by CJ Gustafson

Understanding the difference between audits and taxes taxes are the government’s way of collecting revenue from your earnings, and as an onlyfans creator, your income is taxable Understanding these obligations is crucial for compliance and financial efficiency. Audit accounting involves the role of auditors in reviewing financial statements to ensure accuracy and compliance with tax laws

An audit, on the other hand, is a review of your financial records by the irs to.

Includes forms, tools, and a free tax checklist. This entails organising and making readily available all financial papers, including invoices, contracts, and receipts. For an onlyfans creator—or anyone, really—facing an irs audit can be terrifying However, audits are not as scary as they seem.

As online platforms like onlyfans gain popularity, creators must navigate the complexities of tax filing and deductions unique to this digital income stream