[[LEAK]] Vmfxx State Tax Exempt Full Files HD Media Full Link

Looking for the latest vmfxx state tax exempt premium vault released in January 2026. Our platform provides a massive collection of 4K video sets, high-res images, and exclusive media clips. Unlike other sites, we offer direct download links completely free for our community. See vmfxx state tax exempt with crystal-clear photo quality. The current media pack features unseen video clips, leaked image sets, and full creator archives. Don't miss out on the latest vmfxx state tax exempt video uploads. Start your fast download immediately to unlock the premium gallery.

For the vanguard federal money market fund (vmfxx), this percentage was 59.87% in 2024 Vmfxx does not appear to have met the minimum requirements for any state tax exemption this year in ca, ny, and ct (for reference, it was 49.37% in 2023.) therefore, if you earned $1,000 in total interest from vmfxx in 2024, then $598.70 could possibly be exempt from state and local income taxes

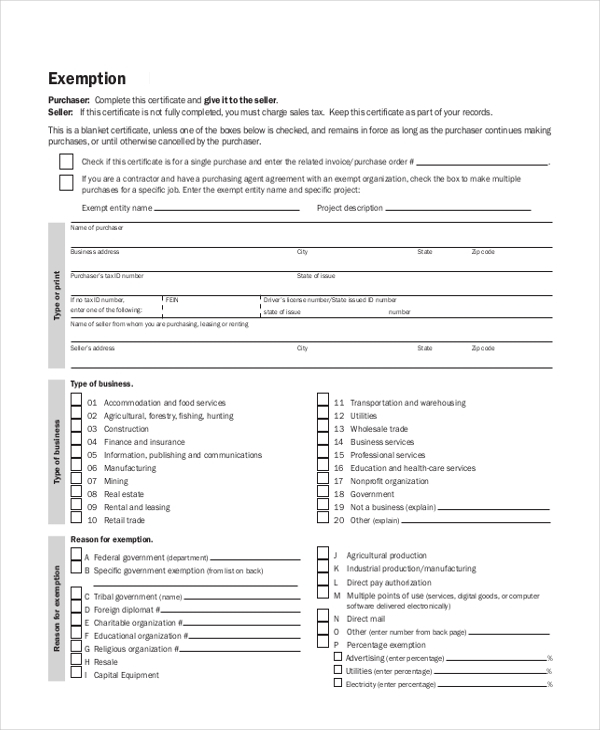

FREE 10 Sample Tax Exemption Forms In PDF MS Word - ExemptForm.com

If your marginal state income tax rate was 10% that would be a ~$60 tax savings for every $1,000 in total interest earned. A portion of these dividends may be exempt from state and/or local tax, depending on where you file your return The state tax exemption and application to your dividends is something you have to do for yourself.

A state or local tax ofice or a tax advisor can help determine whether your state allows the exclusion of some of or all the income earned from mutual funds that invest in u.s

If your state allows an exclusion, refer to the next page for the percentage of ordinary dividends derived from u.s Government obligations that may be excluded for each fund that was invested in. State and local tax treatment