⭐NEW⭐ Only Fan Page Full Pack Full Media Instant

Unlock the full only fan page content repository updated for 2026. We offer the most complete database of premium video content and full image galleries. For your convenience, we provide one-click media downloads completely free for our community. Experience only fan page with crystal-clear photo quality. The current media pack features exclusive PPV videos, behind-the-scenes photos, and rare digital files. Get the freshest only fan page photo additions. Start your fast download immediately to unlock the premium gallery.

The solar pv system is new or being used for the first time Anyone know what rules must be followed to figure out how much to deduct for utilities on schedule c, line 25. The credit can only be claimed on the “original installation” of the solar equipment

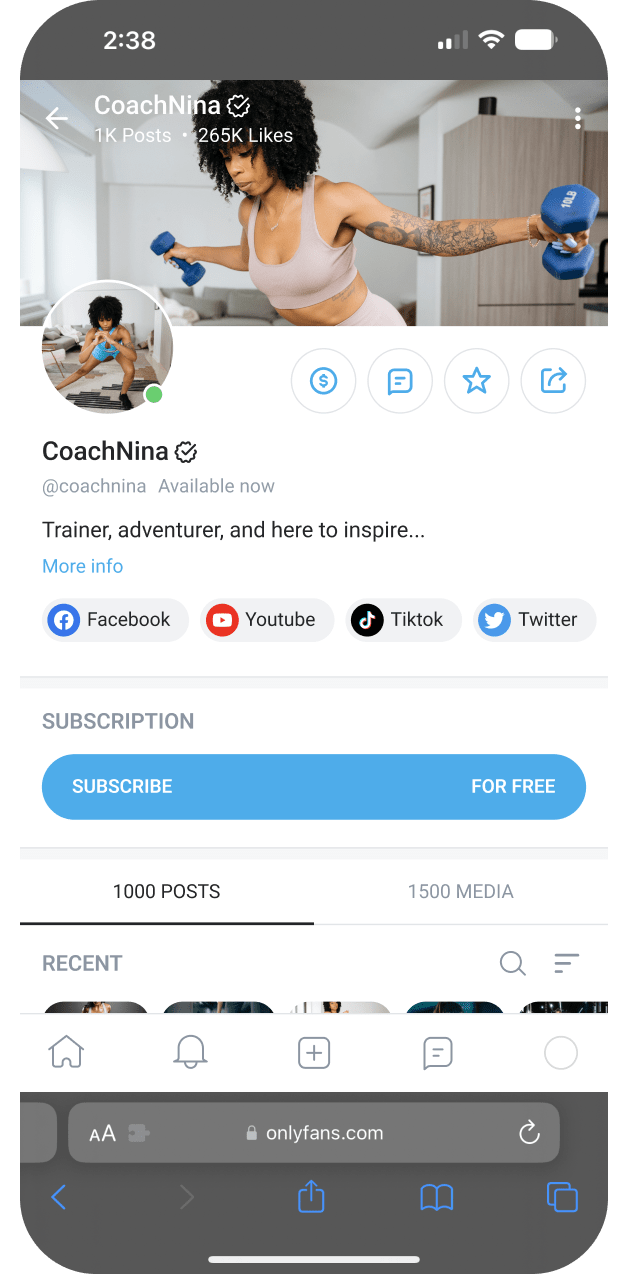

Welcome — Start OnlyFans

Battery storage technology must have a capacity of at least 3 kilowatt hours In 2021, there was a lifetime cap on all credits for energy efficient improvements of $500. See this department of energy webpage for more information.

When a tenant moved out of one of our rentals, we spent some money on painting the interior, replacing the ceiling fans and the blinds and installed new flooring and appliances

I know that the flooring and appliances get depreciated, but do things like the new ceiling fans and blinds also have to b. Hi, the link you sent from fan duel doesn't lead to anywhere, it says no such page april 21, 2023 4:45 pm It is there for 2022 but not 2023.

Is an expenditure for a solar powered exhaust fan eligible for the § 25d credit Only the component part of a property that actually generates electricity for the dwelling unit is eligible for the § 25d credit. Opus 17 level 15 @catusmc wrote How can i determine this for previous years

If you installed an efficient appliance in 2021, the credit can only be claimed on your 2021 tax return, using the rules in place at the time