[[FULL]] What Is Ppv Mean 2026 Folder Vids & Images Download

Looking for the latest what is ppv mean exclusive feed released in January 2026. Inside, you will find a huge library of premium video content and full image galleries. To ensure the best experience, get one-click media downloads completely free for our community. Watch what is ppv mean in stunning 4K clarity. Our latest January folder contains unseen video clips, leaked image sets, and full creator archives. Stay updated with the newest what is ppv mean media drops. Access the full folder today to save the files to your device.

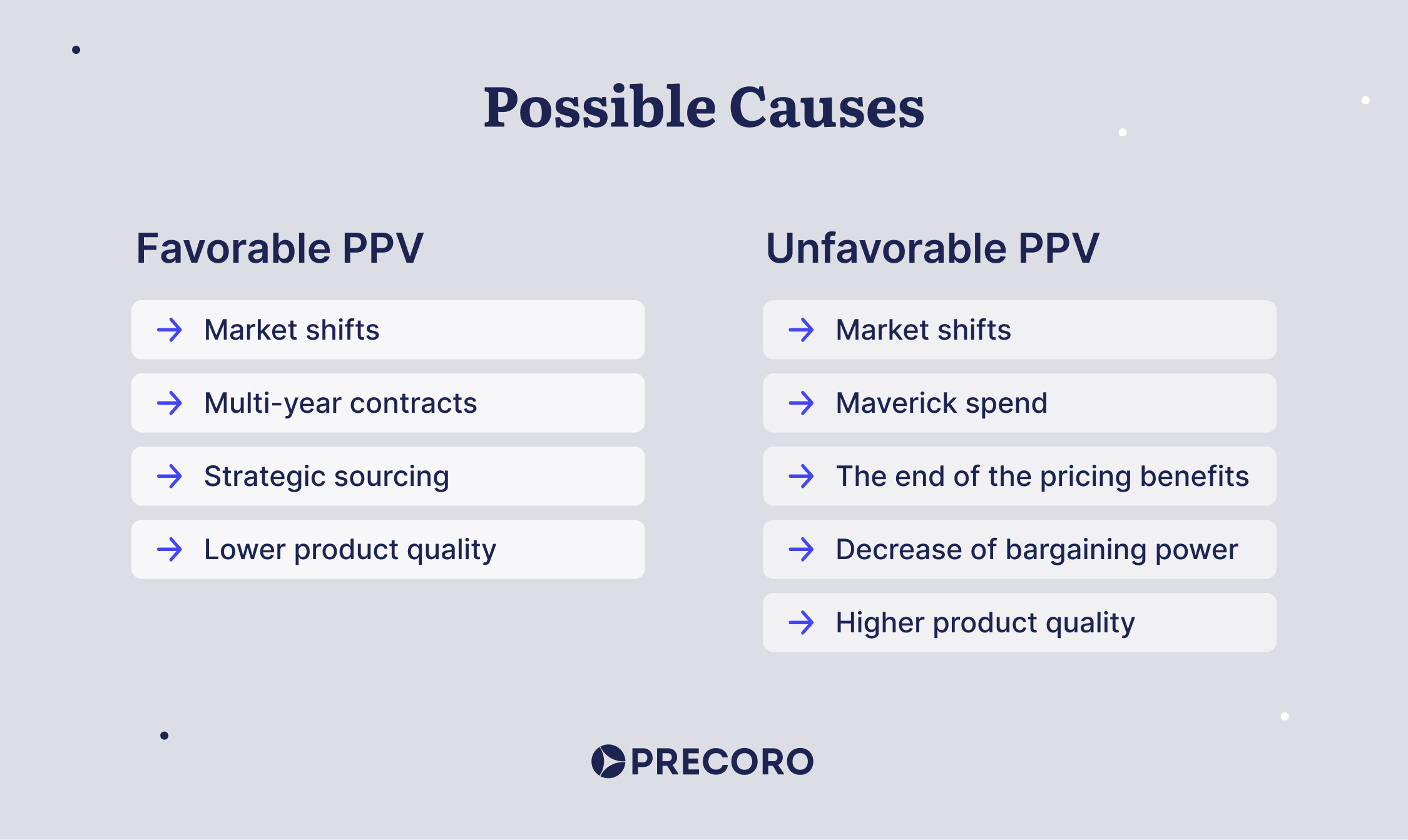

In a business context, ppv refers to purchase price variance Ppv, also known as purchase price variance, is a term used in procurement to refer to the difference between the market rate of a bought item and its actual price. The difference between the expected (or standard) price of an item and the actual price paid

What is PPV — Purchase Price Variance Explained

Ppv is calculated with the following formula Purchase price variance (ppv) is the difference between the standard cost (also known as baseline price) paid on a specific item or service and the actual amount you paid to acquire it. Ppv = (actual price − standard price) × actual quantity

Purchase price variance or ppv is a metric used by procurement teams to measure the effectiveness of the organisation’s or individual’s ability to deliver cost savings

This concept is vital in cost accounting for evaluating the effectiveness of the company’s annual budget exercise. What is the purchase price variance The purchase price variance is used to discover changes in the prices of goods and services It can be used to spot instances in which the purchases being made differ in price from your planning levels.

What does ppv stand for Purchase price variance (ppv) reflects the difference between the actual amount paid for a product or service and the standard or expected amount for the same It is a crucial metric in cost accounting This value indicates the impact of fluctuations in purchase prices on the company's finances.